oklahoma franchise tax phone number

Web Domestic Professional entitiesLLC LP and Corporation being formed pursuant Title 18 Chapter 18 Section 801-819 CANNOT be submitted electronically. Web If you already have a Withholding Tax Account ID you can find this number on correspondence from the Oklahoma Tax Commission.

Oklahoma Sales Use Tax Registration Service Harbor Compliance

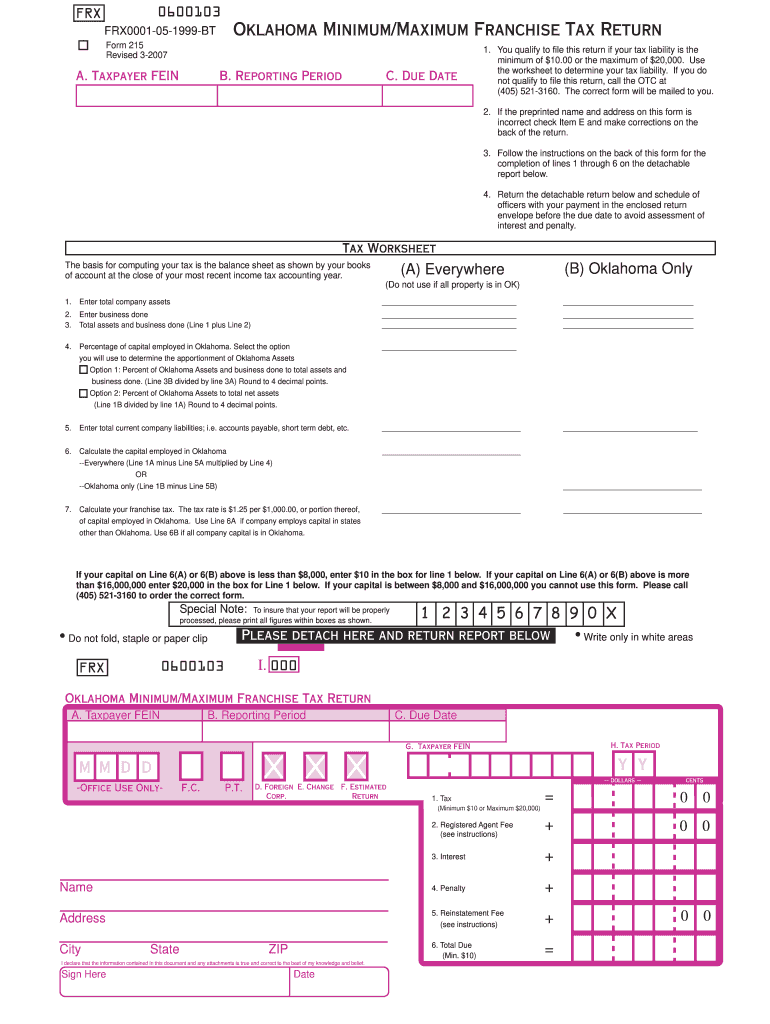

The franchise tax is calculated at a rate of 125 per 1000 of capital employed in or apportioned to the businesss outpost in.

. Web Here are some things you need to know. Oklahoma City OK 73126-0930. A business must file a form with the state to determine whether it is subject to the franchise tax.

Web The in-state toll free number is 800 522-8165. Online Registration Reporting Systems. Web Sales Tax Exemption.

Web Your account ID is a three-letter account type indicator followed by a ten-digit number assigned by the Oklahoma Tax Commission OTC. And interest for late payments of franchise tax 100 of the franchise tax liability must be paid. Electronic Reporting and Webfile Technical Support.

Web Oklahoma Franchise Tax Phone Number. For additional assistance please. The report and tax will be delinquent if not paid on or before August 31.

Web Oklahoma levies a franchise tax on all corporations or associations doing business in the state. Web Business Filing Contact Information Address Business Filing Department 421 NW. Name First MI Last Social Security.

13th Suite 210 Oklahoma City OK 73103 Fax. You MUST provide this information. Corporations are taxed 125 for each 1000 of capital invested or.

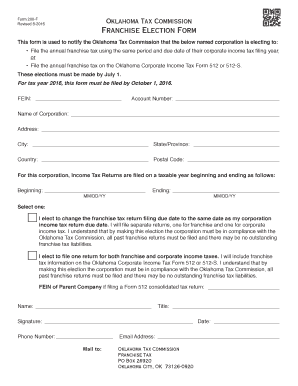

Oklahoma Tax Commission PO Box 26850 Oklahoma City OK 73126-0850 This form is used to notify the Oklahoma Tax. Web Federal Employer Identification Number FEIN. Web We would like to show you a description here but the site wont allow us.

Web Home Address street and number Daytime Phone area code and number City State or Province Country and Postal Code Title 3. The request for your FEIN is authorized by Section 405 Title 42 of the United States Code. First Name Middle Initial Last Name Social.

If a business is subject. Web Home Address street and number Daytime Phone area code and number City State or Province Country Postal Code Title 2. Sales and Use Tax.

Visit Us on the Web. Web Oklahoma Franchise Tax is due and payable July 1st of each year. Web Ledger Reports Oklahoma Equal Opportunity Education Scholarship Credit OTC County Apportionment for Distribution of Tax Revenues.

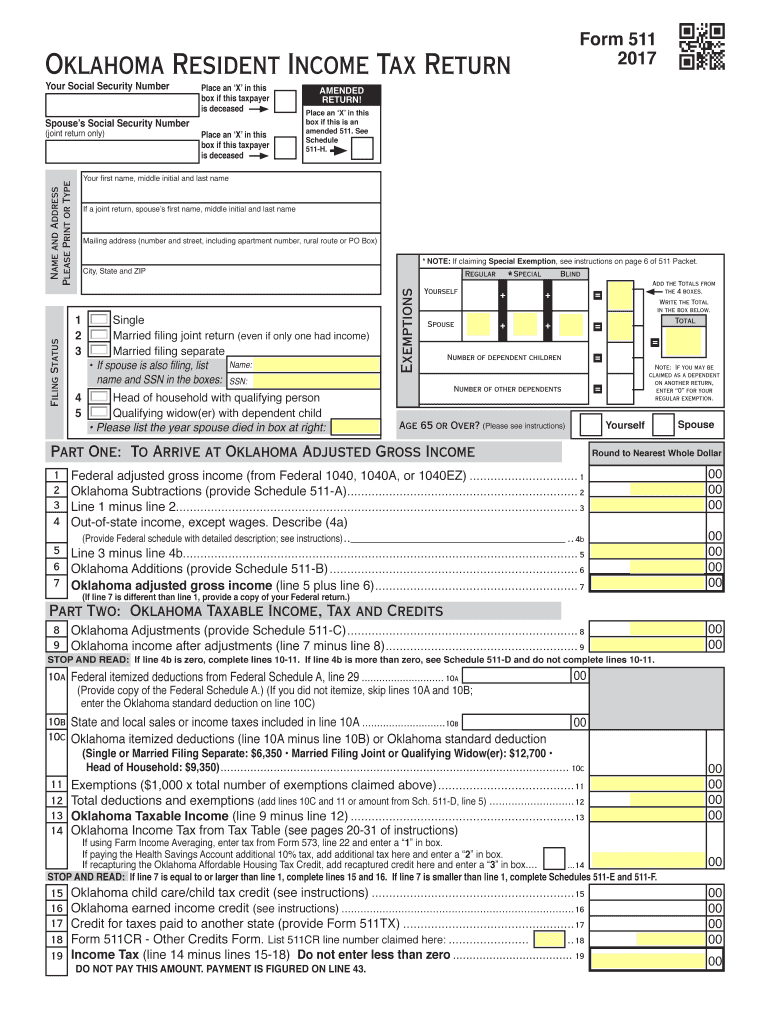

Oklahoma Resident Tax Form 511 2014 Fill Out Sign Online Dochub

Eleventh Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1952 And Ending June 30 1954 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

Filing Your 2021 Oklahoma State Income Taxes

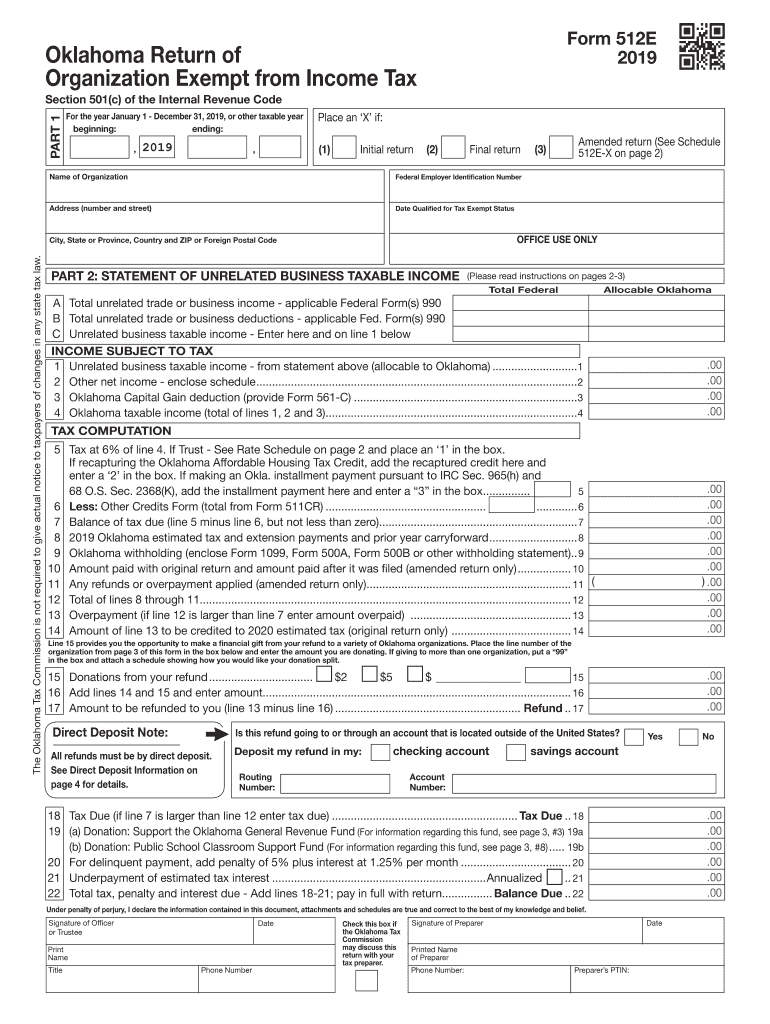

2018 Oklahoma Return Of Organization Exempt From Income Tax Form Fill Out Sign Online Dochub

Free Tax Preparation Program Midwest City Oklahoma

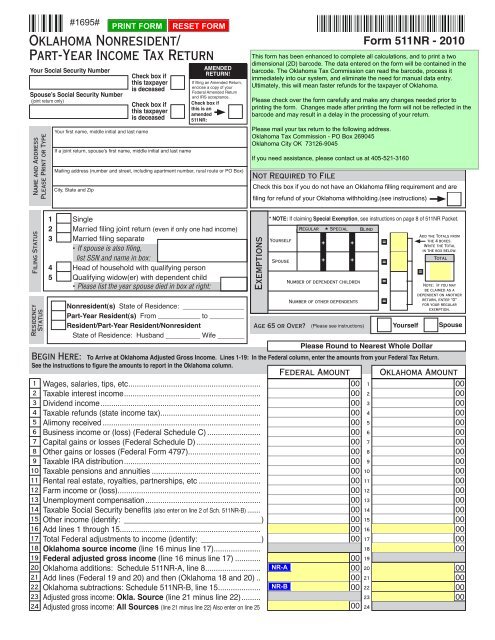

Form 511nr Oklahoma Tax Commission

How To Form An Llc In Oklahoma Llc Filing Ok Swyft Filings

2020 Form Ok 511 538 S Fill Online Printable Fillable Blank Pdffiller

Fillable Online Ok Franchise Election Form Ok Fax Email Print Pdffiller

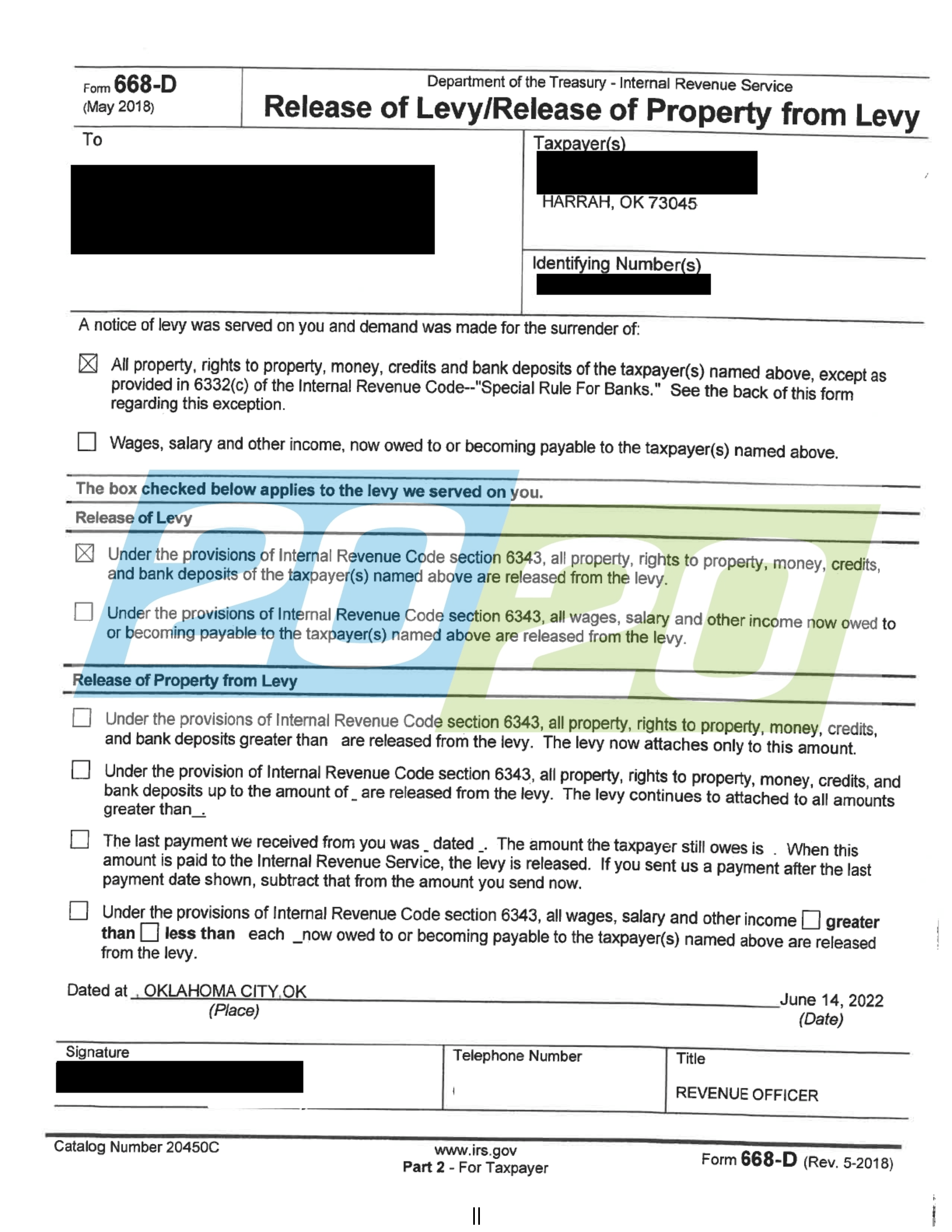

Tax Resolution Examples In Oklahoma 20 20 Tax Resolution

Oklahoma Tax Commission Did You Know Employers May Send Many Types Of 1099s For Various Kinds Of Income If You Received Unemployment The Oklahoma Employment Security Commission Will Send You A

How To File An Amended Return Need To Amend Your Return Watch This Video For A Step By Step Tutorial Otc Taxseason Taxes Oklahomataxseason Oklahoma By Oklahoma Tax Commission Facebook

Personal Income Tax Cuts Won T Deliver Relief To Low And Middle Class Oklahomans Oklahoma Policy Institute

Does Your State Levy A Capital Stock Tax Tax Foundation

Oklahoma S Tax Mix Oklahoma Policy Institute

Oklahoma 215 Fill Out Sign Online Dochub

:watermark(cdn.texastribune.org/media/watermarks/2013.png,-0,30,0)/static.texastribune.org/media/images/2013/05/06/HB500.jpg)

House Gives Early Ok To Bill Targeting Franchise Tax The Texas Tribune

2018 Oklahoma Return Of Organization Exempt From Income Tax Form Fill Out Sign Online Dochub